Reading Time: 2 minutes

Reading Time: 2 minutes

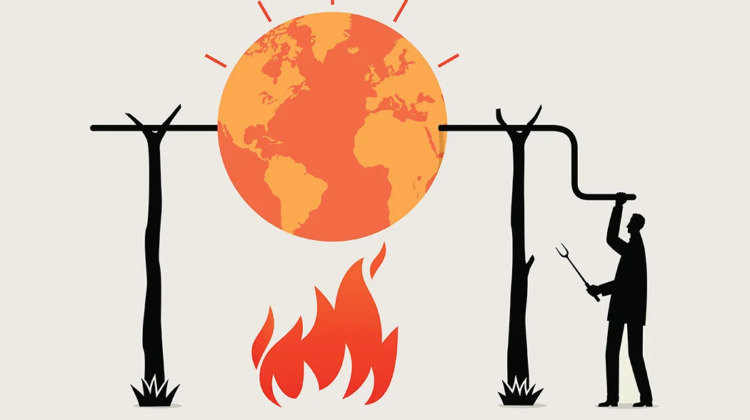

The global consumption of meat, particularly beef, has significant environmental implications. The production of meat,especially ruminant meat, contributes to greenhouse gas emissions, deforestation, and water pollution. Addressing this issue requires a multifaceted approach, including reducing meat consumption and exploring alternative food sources.

The Environmental Impact of Meat Consumption

Meat production, particularly beef, is a major contributor to climate change. The process of raising livestock involves deforestation, methane emissions, and the use of land and water resources. These factors contribute to greenhouse gas emissions and biodiversity loss.

The Need for Reduced Consumption

Reducing meat consumption, especially in developed countries with high consumption rates, is essential for mitigating the environmental impact of the food system. A shift towards plant-based diets can significantly lower emissions and reduce the demand for land and water resources.

The Potential of Meat Taxes

Meat taxes have been proposed as a potential tool to incentivize reduced meat consumption. By making meat more expensive, taxes can encourage consumers to choose more sustainable alternatives. However, the effectiveness of meat taxes is debated, with some arguing that they may disproportionately impact low-income households.

Addressing Concerns and Finding Solutions

To ensure that meat taxes are implemented effectively, it is essential to address several key concerns:

- Equity: Meat taxes should be designed to minimize their impact on low-income households. Redistributive measures can help ensure that the burden of the tax is not borne disproportionately by vulnerable populations.

- Effectiveness: Research is needed to assess the effectiveness of meat taxes in reducing meat consumption and achieving environmental goals.

- Consumer Choice: Meat taxes should not infringe on consumers’ freedom of choice. They should be implemented in a way that encourages sustainable consumption patterns without restricting access to meat.

The issue of meat consumption and its environmental implications is complex and multifaceted. While meat taxes may be one tool to address this problem, a comprehensive approach is needed that includes education, awareness campaigns, and support for sustainable food systems. By working together, we can create a more sustainable and equitable food future.

Leave a Reply